Lenders with $1 Billion or Less in Assets Will be Able to Submit First and Second Draw PPP Applications on Friday – Continuing Dedicated Access for Community-Based Lenders  WASHINGTON – The U.S. Small Business Administration, in consultation with the U.S. Treasury Department, will re-open the Paycheck Protection Program (PPP) loan portal to PPP-eligible lenders with $1 billion or less in assets for First and Second Draw applications on Friday, January 15, 2021 at 9 a.m. EST. The portal will fully open on Tuesday, January 19, 2021 to all participating PPP lenders to submit First and Second Draw loan applications to SBA. Earlier in the week, SBA granted dedicated PPP access to Community Financial Institutions (CFIs) which include Community Development Financial Institutions (CDFIs), Minority Depository Institutions (MDIs), Certified Development Companies (CDCs), and Microloan Intermediaries as part of the agency’s ongoing efforts to reach underserved and minority small businesses. On Friday, SBA will continue its emphasis on reaching smaller lenders and businesses by opening to approximately 5,000 more lenders, including community banks, credit unions, and farm credit institutions. Moreover, the agency also plans to have dedicated service hours for these smaller lenders after the portal fully re-opens next week. “A second round of PPP could not have come at a better time, and the SBA is making every effort to ensure small businesses have the emergency financial support they need to continuing weathering this time of uncertainty,” said SBA Administrator Jovita Carranza. “SBA has worked expeditiously to ensure our policies and systems are re-launched so that this vital small business aid helps communities hardest hit by the pandemic. I strongly encourage America’s entrepreneurs needing financial assistance to apply for a First or Second Draw PPP loan.” “We are pleased to have opened PPP loans to CDFIs, MDIs, CDCs, and Microloan Intermediaries. The PPP is already providing America’s small businesses hardest hit by the pandemic with vital economic relief,” said Secretary of the Treasury Steven T. Mnuchin. “As the Program re-opens for all First and Second Draw borrowers next week, the PPP will allow small businesses to keep workers on payroll and connected to their health insurance.” First Draw PPP Loans are for those borrowers who have not received a PPP loan before August 8, 2020. The first round of the PPP, which ran from March to August 2020, was a historic success helping 5.2 million small businesses keep 51 million American workers employed. Second Draw PPP Loans are for eligible small businesses with 300 employees or less, that previously received a First Draw PPP Loan and will use or have used the full amount only for authorized uses, and that can demonstrate at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020. The maximum amount of a Second Draw PPP loan is $2 million. Updated PPP Lender forms, guidance, and resources are available at www.sba.gov/ppp and www.treasury.gov/cares. About the U.S. Small Business Administration

The U.S. Small Business Administration makes the American dream of business ownership a reality. As the only go-to resource and voice for small businesses backed by the strength of the federal government, the SBA empowers entrepreneurs and small business owners with the resources and support they need to start, grow or expand their businesses, or recover from a declared disaster. It delivers services through an extensive network of SBA field offices and partnerships with public and private organizations. To learn more, visit www.sba.gov.

0 Comments

Community Financial Institutions get dedicated access starting today  WASHINGTON – The U.S. Small Business Administration, in consultation with the U.S. Treasury Department, re-opened the Paycheck Protection Program (PPP) loan portal today at 9 am ET. SBA is continuing its dedicated commitment to underserved small businesses and to addressing potential access to capital barriers by initially granting PPP access exclusively to community financial institutions (CFIs) that typically serve these concerns. When the PPP loan portal re-opened today, it initially accepted First Draw PPP loan applications from participating CFIs, which include Community Development Financial Institutions (CDFIs), Minority Depository Institutions (MDIs), Certified Development Companies (CDCs) and Microloan Intermediaries. These lenders made up approximately 10% of all PPP participating lenders in 2020. A First Draw PPP loan is for those borrowers who have yet to receive a PPP loan before the program closed in August 2020. On Jan. 13, 2021, participating CFIs may begin submitting application information to SBA for Second Draw PPP loans. A Second Draw PPP loan is for certain eligible borrowers that previously received a PPP loan, generally have 300 employees or less, and has suffered a 25% reduction in gross receipts. At least $15 billion is set aside for additional PPP lending by CFIs. A few days later, additional lenders will be able to submit First and Second draw PPP loan applications. SBA will continue to provide updates on systems operations during the week of Jan. 11, 2021. Additionally, SBA plans to dedicate specific times to process and assist the smallest PPP lenders with loan applications from eligible small businesses. The opening of the SBA loan system is designed to efficiently and effectively implement the Economic Aid to Hard-Hit Small Businesses, Nonprofits, and Venues Act and to ensure increased access to the PPP for minority-, underserved-, veteran- and women-owned small business concerns. SBA also is calling upon its lending partners to redouble their efforts to assist eligible borrowers in underserved and disadvantaged communities. Updated PPP Lender forms, guidance, and resources are available at www.sba.gov/ppp. WASHINGTON – The U.S. Small Business Administration (SBA), in consultation with the Treasury Department, announced today that the Paycheck Protection Program (PPP) will re-open the week of January 11 for new borrowers and certain existing PPP borrowers. To promote access to capital, initially only community financial institutions will be able to make First Draw PPP Loans on Monday, January 11, and Second Draw PPP Loans on Wednesday, January 13. The PPP will open to all participating lenders shortly thereafter. Updated PPP guidance outlining Program changes to enhance its effectiveness and accessibility was released on January 6 in accordance with the Economic Aid to Hard-Hit Small Businesses, Non-Profits, and Venues Act. This round of the PPP continues to prioritize millions of Americans employed by small businesses by authorizing up to $284 billion toward job retention and certain other expenses through March 31, 2021, and by allowing certain existing PPP borrowers to apply for a Second Draw PPP Loan. “The historically successful Paycheck Protection Program served as an economic lifeline to millions of small businesses and their employees when they needed it most,” said Administrator Jovita Carranza. “Today’s guidance builds on the success of the program and adapts to the changing needs of small business owners by providing targeted relief and a simpler forgiveness process to ensure their path to recovery.” “The Paycheck Protection Program has successfully provided 5.2 million loans worth $525 billion to America’s small businesses, supporting more than 51 million jobs,” said Treasury Secretary Steven T. Mnuchin. “This updated guidance enhances the PPP’s targeted relief to small businesses most impacted by COVID-19. We are committed to implementing this round of PPP quickly to continue supporting American small businesses and their workers.” Key PPP updates include:

A borrower is generally eligible for a Second Draw PPP Loan if the borrower:

The new guidance released includes:

For more information on SBA’s assistance to small businesses, visit sba.gov/ppp or treasury.gov/cares. ### About the U.S. Small Business Administration

The U.S. Small Business Administration helps power the American dream of business ownership. As the only go-to resource and voice for small businesses backed by the strength of the federal government, the SBA empowers entrepreneurs and small business owners with the resources and support they need to start, grow or expand their businesses, or recover from a declared disaster. It delivers services through an extensive network of SBA field offices and partnerships with public and private organizations. To learn more, visit www.sba.gov.

WASHINGTON – Today, the U.S. Small Business Administration, in consultation with the U.S. Treasury Department, announced that it is setting aside $10 billion of Round 2 funding for the Paycheck Protection Program (PPP) to be lent exclusively by Community Development Financial Institutions (CDFIs). CDFIs work to expand economic opportunity in low-income communities by providing access to financial products and services for local residents and businesses. These dedicated funds will further ensure that the PPP reaches all communities in need of relief during the COVID-19 pandemic – a key priority for President Trump.

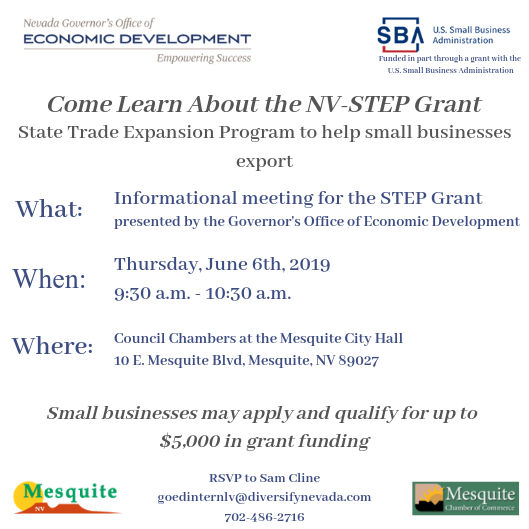

“The forgivable loan program, PPP, is dedicated to providing emergency capital to sustain our nation’s small businesses, the drivers of our economy, and retain their employees,” said SBA Administrator Jovita Carranza. “CDFIs provide critically important capital and technical assistance to small businesses from rural, minority and other underserved communities, especially during this economically challenging time.” “The PPP has helped over 50 million American workers stay connected to their jobs and over 4 million small businesses get much-needed relief,” said Treasury Secretary Steven T. Mnuchin. “We have received bipartisan support for dedicating these funds for CDFIs to ensure that traditionally underserved communities have every opportunity to emerge from the pandemic stronger than before.” As of May 23, 2020, CDFIs have approved more than $7 billion ($3.2 billion in Round 2) in PPP loans. The additional $6.8 billion will ensure that entrepreneurs and small business owners in all communities have easy access to the financial system, and that they receive much-needed capital to maintain their workforces. The Paycheck Protection Program was created by the Coronavirus, Aid, Relief, and Economic Security Act (CARES Act) and provides forgivable loans to small businesses affected by the COVID-19 pandemic to keep their employees on the payroll. To date, more than 4.4 million loans have been approved for over $510 billion for small businesses across America. The SBA and the Treasury Department remain committed to ensuring eligible small businesses have the resources they need to get through this time. ### About the U.S. Small Business Administration The U.S. Small Business Administration makes the American dream of business ownership a reality. As the only go-to resource and voice for small businesses backed by the strength of the federal government, the SBA empowers entrepreneurs and small business owners with the resources and support they need to start, grow or expand their businesses, or recover from a declared disaster. It delivers services through an extensive network of SBA field offices and partnerships with public and private organizations. To learn more, visit www.sba.gov. Resources are Available to Nevada Small Business to Assist in Expansion into the Global Marketplace5/31/2019 Nevada GOED to hold informational meeting in Mesquite City Hall on June 6MESQUITE, Nev. – Federal grant money is available to Nevada small businesses to open the door of the global marketplace to them, but many business owners just never apply for the free federal dollars. The Nevada Governor’s Office of Economic Development (GOED) will hold an informational seminar next week to illustrate the benefits of the state’s exporting resources. Small business owners and leaders are encouraged to attend an informational meeting about the State Trade Expansion Program (STEP) grant on Thursday, June 6, at 9:30 a.m. in the Council Chambers at Mesquite City Hall, 10 E. Mesquite Blvd., hosted by GOED, the City of Mesquite and the Mesquite Chamber of Commerce. So far this year 13 small Nevada businesses have taken advantage of the grant and have been awarded nearly $90,000. “There are many great state programs designed to help small businesses, especially the STEP grant which provides businesses with money to help begin exporting their goods or help them expand their export market,” said Gov. Steve Sisolak. “I would encourage all business owners to attend this meeting to learn more about how the STEP grant can help their businesses thrive.” GOED approves applications for the funding through the Small Business Administration’s (SBA) STEP grant. Businesses can get awards up to $5,000 to assist with pre-approved export expenses such as foreign market sales trips, trade show activities, international marketing materials, export trade show exhibits, overseas interpreters and training workshops. “Small businesses fuel Nevada’s economy and expanding into foreign markets will put them on a path to grow their businesses,” said GOED Interim Executive Director Kris Sanchez. “If a business is considering expanding into global trade, they should apply for a STEP grant.” Many times, the only way for Nevada businesses to connect with buyers all over the world is to attend trade shows in foreign markets. The STEP grant can help defray the cost of a business owner attending trade shows and creating global market promotional materials for the business. For more information about the Nevada GOED’s STEP grants or to apply, visit diversifynevada.com. The STEP program is funded in part through a grant with the SBA. About the Governor’s Office of Economic Development

Created during the 2011 session of the Nevada Legislature, the Governor’s Office of Economic Development is the result of a collaborative effort between the Nevada Legislature and the Governor’s Office to restructure economic development in the state. GOED’s role is to promote a robust, diversified and prosperous economy in Nevada, to stimulate business expansion and retention, encourage entrepreneurial enterprise, attract new businesses and facilitate community development. More information on the Governor’s Office of Economic Development can be viewed at diversifynevada.com. |

Archives

March 2021

Categories

All

|

RSS Feed

RSS Feed